Credit union benefits sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with an American high school hip style and brimming with originality from the outset.

Credit unions have been revolutionizing the financial landscape, providing a fresh alternative to traditional banks with a focus on community, personalized service, and financial empowerment. Let’s dive into the world of credit union benefits and discover how they can transform your financial journey.

Overview of Credit Union Benefits

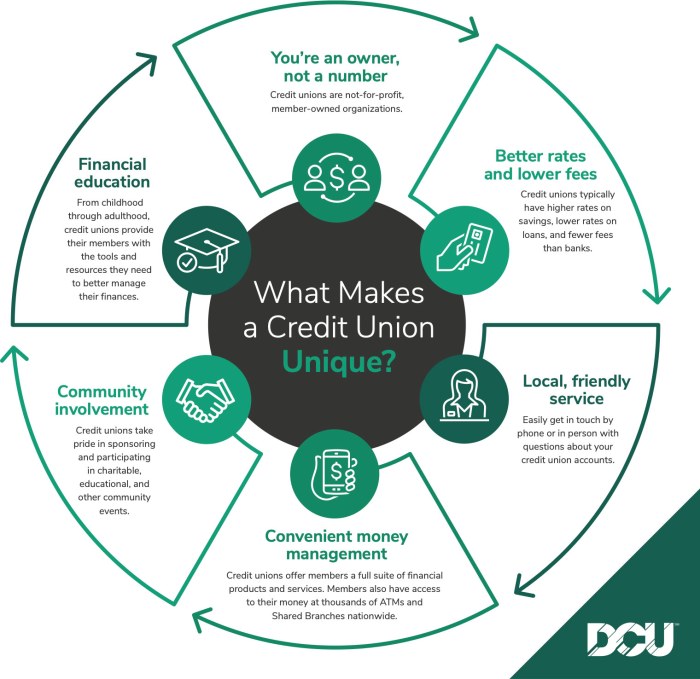

Credit unions are financial institutions that are member-owned and operated, unlike traditional banks that are for-profit organizations. The key difference is that credit unions focus on serving their members and the community, rather than maximizing profits for shareholders.

Key Advantages of Credit Unions

- Credit unions typically offer better interest rates on savings accounts and loans compared to banks. This means members can earn more on their deposits and pay less in interest on loans.

- Lower fees are another major benefit of credit unions. Many credit unions have fewer fees and lower account minimums than banks, making it more affordable for members to manage their finances.

- Personalized customer service is a hallmark of credit unions. Members often have direct access to decision-makers and can receive tailored financial advice based on their individual needs and goals.

Membership Benefits

Joining a credit union is all about being part of a tight-knit community that’s got your back when it comes to your finances. To become a member, you typically need to meet specific eligibility criteria, such as living in a certain area, working for a particular employer, or belonging to a certain organization.Once you’re in, the exclusive benefits start rollin’ in.

Members often enjoy lower loan rates, higher interest rates on savings accounts, and fewer fees compared to traditional banks. Plus, credit unions are known for their personalized service and community-focused approach to banking.

Enhanced Financial Well-being

When you’re a credit union member, you’re not just a number, you’re part of a family that’s dedicated to helping you achieve your financial goals. By having access to lower rates and better terms on loans and credit cards, members can save big bucks in interest payments over time. This can lead to improved credit scores and overall financial health.

So, joinin’ a credit union ain’t just about banking – it’s about building a brighter financial future for yourself and your community.

Financial Products and Services

Credit unions offer a wide range of financial products and services to their members, similar to traditional banks. However, credit unions often provide unique offerings that set them apart from traditional financial institutions.

Checking and Savings Accounts

Credit unions offer various types of checking and savings accounts to help members manage their day-to-day finances. These accounts typically come with lower fees and higher interest rates compared to traditional banks.

Loans and Mortgages

Credit unions provide loans for various purposes, including personal loans, auto loans, and mortgages. Members can benefit from lower interest rates and flexible repayment terms when obtaining loans from a credit union.

Credit Cards

Credit unions offer credit cards with competitive interest rates and rewards programs for their members. These credit cards often have lower fees and more favorable terms than those offered by traditional banks.

Investment Services

Some credit unions provide investment services to help members grow their wealth and achieve their financial goals. These services may include retirement planning, investment advice, and portfolio management.

Insurance Products

Credit unions offer insurance products such as auto insurance, home insurance, and life insurance to provide members with financial protection and peace of mind. Members can often obtain these insurance products at competitive rates through their credit union.

Community Involvement and Support

Credit unions play a vital role in supporting and giving back to their local communities. Their focus on community involvement sets them apart from traditional banks and financial institutions.

Local Initiatives

- Credit unions often sponsor local events such as charity runs, food drives, and community clean-up projects. These initiatives help bring people together and create a sense of unity within the community.

- They also provide financial literacy programs and workshops to educate community members on important money management skills, ultimately empowering individuals to make informed financial decisions.

- Many credit unions offer scholarships to local students, supporting education and helping young people achieve their academic goals.

Impact on Community Development

- By supporting local businesses through loans and financial assistance, credit unions help stimulate economic growth in the community.

- They prioritize personalized service and a focus on member needs, fostering a strong sense of trust and loyalty among community members.

- Credit unions often partner with non-profit organizations and community groups to address social issues and improve the overall well-being of the community.

Customer Service and Member Experience

In the world of credit unions, customer service and member experience are top priorities. The personalized service experience sets credit unions apart from traditional banks, creating a sense of community and trust among members.

Exceptional Member Service, Credit union benefits

At credit unions, members are not just another number. They are valued individuals who receive personalized attention and care. From helping members navigate financial decisions to providing guidance on savings and loans, credit union staff go above and beyond to ensure member satisfaction.

- Recently, a member shared their experience of facing financial hardship due to a medical emergency. The credit union not only offered flexible payment options but also provided emotional support, showing true empathy and understanding.

- In another instance, a member praised the credit union for helping them secure a low-interest rate on a mortgage, saving them thousands of dollars in the long run. The staff took the time to explain the process and ensure the member felt confident in their decision.

Priority on Member Satisfaction

Credit unions prioritize member satisfaction above all else. This means going the extra mile to meet members’ needs, whether it’s providing financial education, offering competitive rates, or simply being there to listen and support during tough times.

“Our members are at the heart of everything we do. Their satisfaction and financial well-being are our top priorities, and we strive to exceed their expectations every day.”

Credit Union Representative

Financial Education and Resources: Credit Union Benefits

Financial education is a key component of the services provided by credit unions. By offering educational resources and programs, credit unions empower their members to make informed financial decisions and achieve their financial goals.

Importance of Financial Literacy Programs

Financial literacy programs offered by credit unions play a crucial role in helping members understand essential financial concepts, such as budgeting, saving, investing, and managing debt. These programs aim to improve members’ financial knowledge and skills, leading to better financial outcomes and increased financial stability.

- Financial literacy programs help members develop a strong foundation of financial knowledge, enabling them to make informed decisions about their money.

- By educating members on topics like credit scores, interest rates, and retirement planning, credit unions help them navigate the complexities of the financial world.

- Empowering members with financial education can lead to improved financial well-being, reduced financial stress, and increased confidence in managing their finances.