First-Time Home Buying Tips sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Are you ready to dive into the world of real estate and make your first home purchase? Buckle up as we take you on a ride through the essential tips and tricks every first-time homebuyer needs to know.

Factors to Consider Before Buying

When preparing to buy your first home, there are several key financial considerations that first-time homebuyers need to keep in mind. Assessing your readiness for homeownership and understanding the importance of your credit score are crucial steps in the home buying process.

Key Financial Considerations

- Calculate your budget carefully to determine how much you can afford to spend on a home. Consider factors such as your income, existing debts, and monthly expenses.

- Save up for a down payment to secure better mortgage rates. Aim for at least 20% of the home’s purchase price to avoid private mortgage insurance (PMI).

- Understand the additional costs of homeownership, including property taxes, homeowners insurance, maintenance, and repairs.

Assessing Readiness for Homeownership

- Evaluate your long-term goals and stability in your current job and location to determine if buying a home is the right decision for you.

- Consider your future plans, such as starting a family or changing careers, and how they may impact your ability to afford and maintain a home.

- Ensure you have a healthy emergency fund in place to cover unexpected expenses that may arise as a homeowner.

Importance of Credit Score

- Your credit score plays a significant role in determining your mortgage eligibility and interest rates. Aim for a score of 620 or higher for better mortgage options.

- To improve your credit score, pay bills on time, keep credit card balances low, and avoid opening new lines of credit before applying for a mortgage.

- Regularly review your credit report for errors and work to correct any discrepancies to maintain a healthy credit profile.

Researching the Market

Researching the real estate market is crucial for first-time home buyers to make informed decisions. By understanding market trends, pricing, and inventory, buyers can navigate the buying process more effectively.

Significance of Location

Location plays a significant role in home buying decisions. Factors such as proximity to schools, work, shopping centers, and public transportation can impact the value of a property. Researching the neighborhood’s safety, amenities, and future development plans can help buyers determine if the location aligns with their lifestyle and investment goals.

Types of Properties

When exploring properties, first-time buyers may encounter various options such as single-family homes, condos, townhouses, and multi-family units. Each type of property comes with its own set of benefits and considerations. Single-family homes offer privacy and space but require more maintenance, while condos provide convenience with shared amenities but come with HOA fees. Townhouses blend aspects of both single-family homes and condos, making them a popular choice for first-time buyers looking for a middle ground.

Multi-family units can be a good investment opportunity for buyers interested in rental income. It’s essential for buyers to weigh the pros and cons of each property type based on their budget, lifestyle, and long-term goals.

Understanding the Homebuying Process: First-Time Home Buying Tips

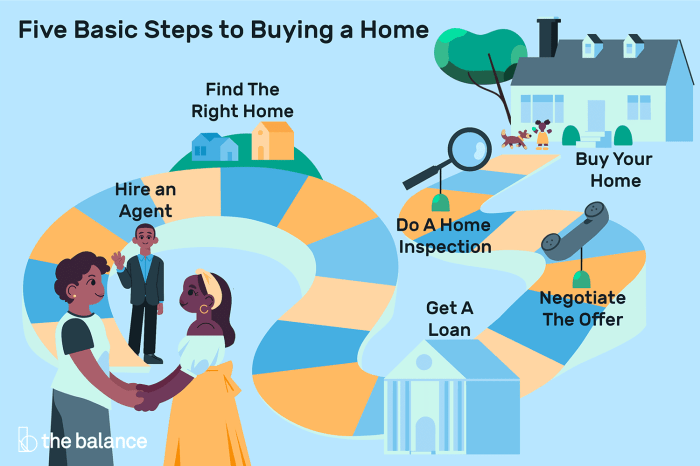

When it comes to buying a home, there are several crucial steps involved that every first-time homebuyer should be aware of. From finding the right real estate agent to navigating through home inspections, understanding the homebuying process is key to a successful purchase.

Role of Real Estate Agents

Real estate agents play a vital role in the homebuying process. They help you find properties that match your criteria, negotiate offers on your behalf, and guide you through the paperwork. When choosing a real estate agent, make sure to look for someone with experience in the local market, good communication skills, and a strong track record of successful transactions.

Importance of Home Inspections

Home inspections are a crucial step in the homebuying process as they help uncover any potential issues with the property that may not be visible to the naked eye. It is important to hire a qualified home inspector to thoroughly examine the property for any structural, mechanical, or safety concerns. By understanding the results of the home inspection, you can make an informed decision about the property and negotiate repairs or adjustments with the seller.

Financial Tips for First-Time Buyers

Saving up for a down payment and understanding mortgage options are crucial steps for first-time homebuyers. Additionally, budgeting for ongoing homeownership costs is essential to avoid financial strain in the long run.

Down Payment Savings, First-Time Home Buying Tips

- Start by setting a savings goal for your down payment, typically around 20% of the home’s purchase price.

- Consider automating your savings by setting up a separate account specifically for your down payment fund.

- Look for ways to increase your income or cut expenses to boost your savings rate.

- Explore down payment assistance programs or grants that may be available to first-time buyers.

Types of Mortgages

- Fixed-Rate Mortgage: Offers a stable interest rate and monthly payment throughout the loan term.

- Adjustable-Rate Mortgage (ARM): Initial interest rate is lower but can fluctuate after a certain period.

- FHA Loans: Insured by the Federal Housing Administration, allowing for lower down payments and credit score requirements.

- VA Loans: Available to veterans, active-duty service members, and eligible spouses with no down payment required.

Budgeting for Homeownership Costs

- Factor in property taxes, homeowners insurance, maintenance, and potential HOA fees when budgeting for a new home.

- Set aside an emergency fund for unexpected repairs or expenses that may arise as a homeowner.

- Consider the impact of utilities, landscaping, and other ongoing costs on your monthly budget.

- Consult with a financial advisor to ensure you have a comprehensive understanding of your financial responsibilities as a homeowner.